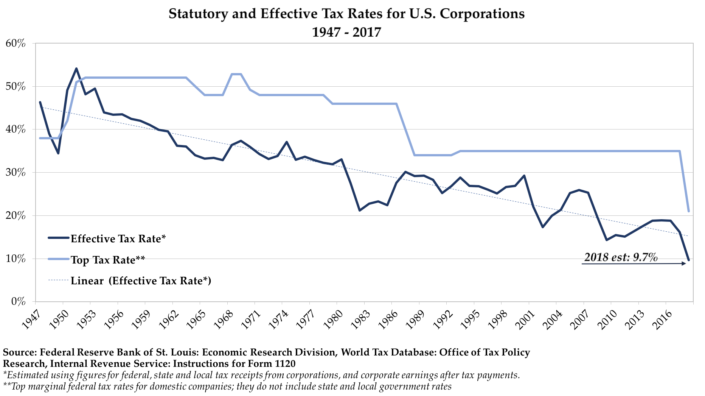

The Corporate Tax Myth. The only part of the 2018 tax cuts that… | by Avi Deutsch | Vodia Capital | Medium

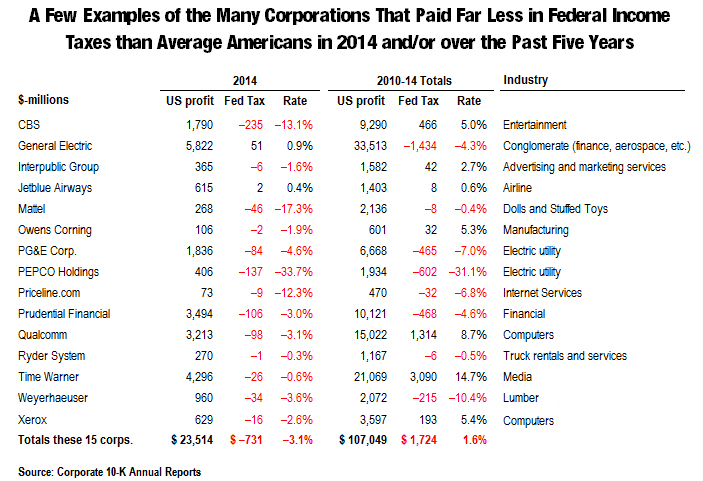

10 companies in the Fortune 500 with lower income tax rates than the average American family - Economic Opportunity Institute Economic Opportunity Institute

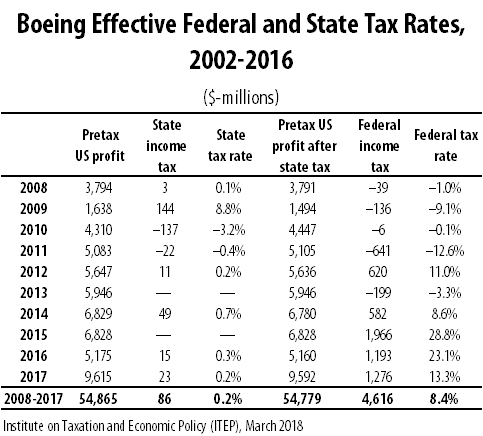

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut – ITEP

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)